New York City Starts Fiscal Year 2025 with Strong Revenue Growth and Solid Financial Health

New York City has begun fiscal year 2025 with a strong financial position, marked by rising revenues, controlled expenditures, and a steady cash balance. As the city continues its recovery from recent challenges, the latest financial figures reveal positive momentum across key economic sectors and thoughtful allocation of public funds.

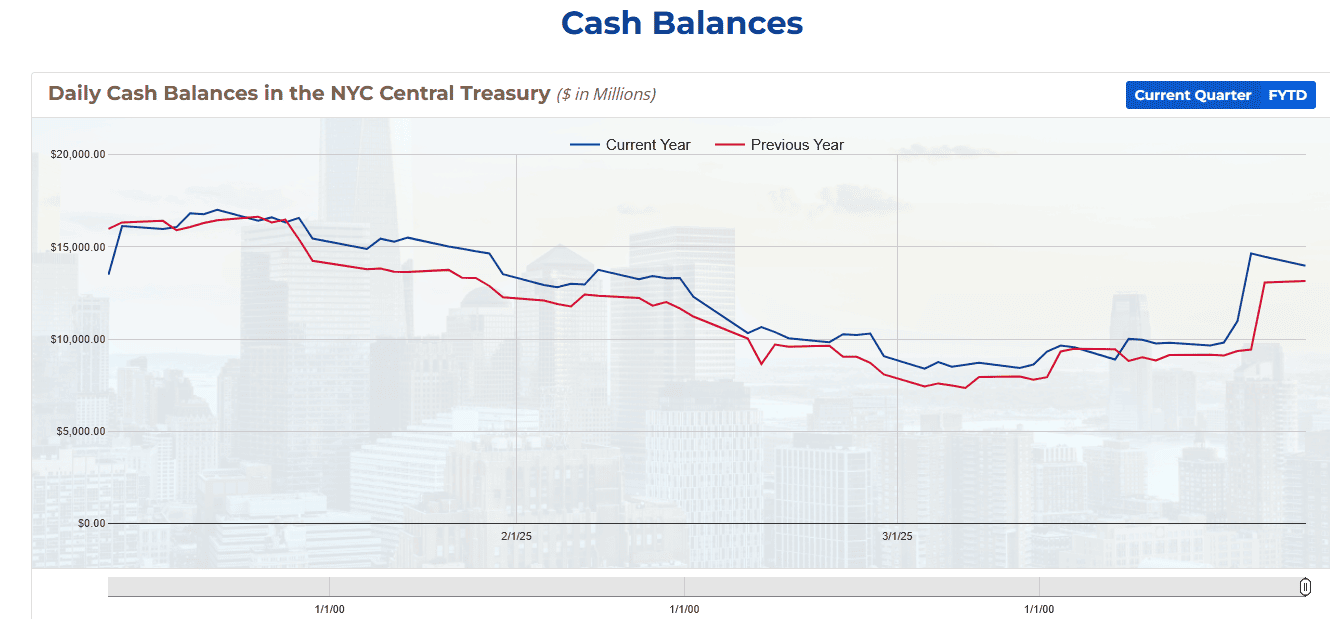

City Cash Reserves and Fiscal Overview

At the start of fiscal year 2025 (FY25), New York City reported $10.41 billion in cash-on-hand. While this is slightly lower than the $12.39 billion at the same time last year, the city maintained an average cash balance of approximately $10.1 billion over the first nine months of the fiscal year, reflecting prudent financial management amid ongoing expenditures.

During this period, the city collected $105.57 billion in total receipts, surpassing expenditures of $102 billion. This marks a net positive difference of $3.56 billion and represents both the highest revenue and spending levels recorded for this timeframe. Receipts rose by 10.2% year-over-year, while expenditures increased by 7.4%.

Growth in Tax Revenues Drives City Economy

Tax revenues remain the backbone of the city’s fiscal strength, with total tax receipts surpassing $60 billion, up 10.3% compared to the previous year. This growth is only partly influenced by the timing of property tax collections, signaling an underlying robust economic environment.

Notably, Wall Street profits nearly doubled in calendar year 2024, with record-breaking bonus payouts contributing significantly to increased personal income and business tax revenues. The residential real estate market is showing signs of revival, supported by improving demand in high-end office spaces. Tourism continues to thrive, with visitor numbers nearing pre-pandemic levels of 2019, further fueling city revenues.

Federal Aid and Capital Investments Bolster City Finances

Beyond tax income, the city’s cash receipts were strengthened by nearly $4.93 billion in COVID-19-related aid and FEMA reimbursements. Capital reimbursements also grew substantially by 23.6%, totaling an additional $2.11 billion compared to the previous year. Excluding these reimbursements, total receipts still climbed 8.9%, underscoring broad-based fiscal health.

Strategic Spending on Social Services and Infrastructure

Expenditure increases are mainly attributed to expanded public assistance and social service programs. These include cash assistance, rental and childcare support, and shelter provisions for vulnerable populations such as single adults, families, and asylum seekers.

The city also dedicated more funds to early childhood education through the 3-K program and absorbed rising costs related to special education. Capital expenditures increased by 7.4%, but these were balanced by capital reimbursements, maintaining fiscal discipline.

Cash Balances Reflect Consistent Stability

By the end of March 2025, the city’s cash balance rose to $13.97 billion, slightly higher than the $13.14 billion recorded a year prior. This balance includes nearly $2 billion in the Revenue Stabilization Fund, New York City’s designated rainy-day reserve that ensures readiness for unforeseen financial challenges.

Third Quarter Highlights: Revenue and Expenditure Trends

From January to March 2025, the city averaged $12.46 billion in cash reserves, reflecting a year-over-year increase. Cash receipts during this quarter totaled $34.95 billion, a 4.2% rise from the previous year.

Tax revenue amounted to $20.08 billion, slightly down from the prior year largely due to timing differences in real property tax payments. Real property tax collections were $6.31 billion in January 2025, compared to $7.77 billion in January 2024 when some payments were recorded early.

Meanwhile, all other taxes rose by 17.2%, bolstered by a 14.4% increase in combined federal and state aid. The quarter also saw $3.47 billion in capital transfers, an 18% increase over the previous year.

Detailed Tax Revenue Breakdown

Real Property Tax: Rose 9.2% to $27.64 billion for FY25, supported by a 4.4% increase in taxable assessed property values.

Non-Property Taxes: Increased 11.3%, with personal income tax (including Pass-Through Entity Tax) climbing 16%, and business tax revenues up 12.8%.

Sales Tax: Modest growth of 2.8%, reflecting inflation-adjusted consumer spending rather than robust sales volume increases.

Mortgage and Real Property Transfer Taxes: Up 13.8%, benefiting from a cooling yet rebounding housing market.

Commercial Rent Tax: Rose 3.2% amid tightening office vacancies and rising rents.

Hotel Occupancy Tax: Grew 12.4% with occupancy rates near pre-pandemic levels and increased room rates.

Expenditure Analysis: Focus on Personnel and Social Services

Total cash expenditures for the third quarter reached $34.17 billion, up 7.8% from last year after adjusting for capital expenses. Personnel costs grew modestly by 2.4%, reflecting stable staffing levels and benefit adjustments.

Non-personnel expenses increased significantly by 10.5%, driven by expanded social services including migrant assistance, housing support, and childcare programs. Spending on homeless shelters and rental assistance saw notable increases, reflecting the city’s commitment to addressing urgent social needs.

Managing Migrant and Asylum Seeker Support

The city allocated $2.58 billion towards migrant-related costs during FY25, an increase from $2.37 billion the prior year. Spending on sanctuary shelters rose 80% to $807 million. Meanwhile, medical care and other essentials provided through vendor contracts remained substantial, although slightly reduced.

Funding for Humanitarian Emergency Response and Relief Centers, operated by the city’s health system, reached $1 billion in FY25, supporting over 5,300 asylum seekers residing in city-managed facilities as of April 2025.

Capital Investments and Debt Issuance

Capital expenditures for the third quarter were $3.98 billion, an 8% increase, with city-funded projects up 10.8%. Although non-city-funded capital spending declined sharply, reimbursements exceeded expenditures by $162 million year-to-date, a positive reversal from previous years.

The city plans to issue $17.73 billion in new bonds for capital projects in 2025, an increase from earlier projections. Through the first three quarters, $12.65 billion in new money bonds and $6.61 billion in refunding bonds were issued, including several major bond sales with substantial budget savings.

Outlook for Fiscal Stability and Growth

New York City’s financial report for FY25 underscores a resilient economy with strong revenue streams and careful spending strategies. While challenges such as social service demands and infrastructure needs persist, the city’s robust cash reserves and proactive fiscal management position it well for sustainable growth and continued recovery.

COMMENTS (0)

Sign in to join the conversation

LOGIN TO COMMENT